What is GST State Code?

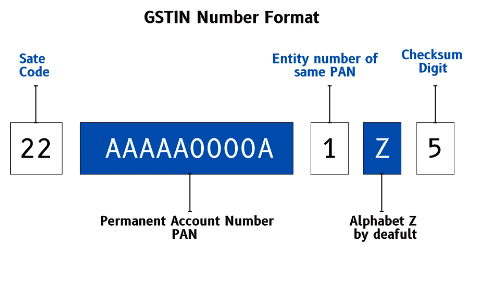

GST State Code list has been allotted by the Government of India to every state and union territory. These numeric codes are used to identify states and union territories for the purpose of Goods and Services Tax (GST) registration and taxation. Each state is assigned a unique two-digit code, which simplifies the identification of taxpayers based on their location. The first two digits of the GSTIN (Goods and Services Tax Identification Number) represent the state code. Below is a table showing the GST state codes along with their corresponding State/Union Territory names and Tax Identification Numbers (TINs).

List of Indian States, Union Territories and their TINs

| State Code | State/Union Territory | TIN |

|---|---|---|

| JK | Jammu & Kashmir | 01 |

| HP | Himachal Pradesh | 02 |

| PB | Punjab | 03 |

| CH | Chandigarh | 04 |

| UK | Uttarakhand | 05 |

| HR | Haryana | 06 |

| DL | Delhi | 07 |

| RJ | Rajasthan | 08 |

| UP | Uttar Pradesh | 09 |

| BR | Bihar | 10 |

| SK | Sikkim | 11 |

| AR | Arunachal Pradesh | 12 |

| NL | Nagaland | 13 |

| MN | Manipur | 14 |

| MZ | Mizoram | 15 |

| TR | Tripura | 16 |

| ML | Meghalaya | 17 |

| AS | Assam | 18 |

| WB | West Bengal | 19 |

| OD | Odisha | 21 |

| CT | Chhattisgarh | 22 |

| MP | Madhya Pradesh | 23 |

| GJ | Gujarat | 24 |

| DD | Daman & Diu | 25 |

| DN | Dadra & Nagar Haveli & Daman & Diu | 26 |

| MH | Maharashtra | 27 |

| KA | Karnataka | 29 |

| GA | Goa | 30 |

| LD | Lakshadweep | 31 |

| KL | Kerala | 32 |

| TN | Tamil Nadu | 33 |

| PY | Puducherry | 34 |

| AN | Andaman & Nicobar Islands | 35 |

| TS | Telangana | 36 |

| AP | Andhra Pradesh | 37 |

| LA | Ladakh | 38 |

| OT | Other Territory | 97 |

GST State Code is an essential element in the GSTIN (Goods and Services Tax Identification Number). It helps identify the state in which a taxpayer is registered and is crucial for determining the Place of Supply for taxation purposes. This identification enables the correct allocation of taxes to the respective state, ensuring compliance with tax laws and facilitating smooth transactions under the GST system.

For example, if my GSTIN is registered in Delhi, the first two digits of my GSTIN will represent Delhi’s state code (07). When I sell goods locally within Delhi (intra-state), the taxes are split into CGST (Central GST) and SGST (State GST), as both the supplier and the place of supply are within the same state.

However, when I sell goods to another state, such as Maharashtra, the GST state code of the buyer will reflect Maharashtra (27). Since this is an inter-state transaction, the tax will be allocated under IGST (Integrated GST), which applies to transactions between different states. The correct allocation of tax depends on the state codes, ensuring compliance and accurate distribution of taxes to the appropriate government authorities.

Importance of GST State Code

The GST State Code is important for identifying the state or union territory where a business is registered. It is used in various aspects of the GST system, including:

- GST Registration: State Code is a component of the GSTIN and is used on all GST-related documents and during registration.

- Invoicing: State Code is used to determine the type of GST applicable on a transaction, whether it is IGST, CGST, or SGST.

- Return Filing: State Code is used to identify the state where the GST return is to be filed.

FAQ

GSTIN stands for Goods and Services Tax Identification Number, which is a 15-digit unique identification number assigned to each taxpayer registered under the GST system.

The structure of GSTIN is as follows: State Code (2 digits) + PAN Number (10 digits) + Entity Code (3 digits) + Check Digit (1 digit).

The GST State Code is used to identify the state or union territory where a business is registered, and it is an essential component of the GSTIN

You can find your GST State Code on your GSTIN, which is provided by the GST portal during registration

GST State Code of Karnataka (Bangalore) is 29.

GST State Code Maharashtra (Mumbai) is 27

GST State Code of Kerala is 32

GST State Code of Andhra Pradesh is 37